Are you moving to Canada? Do you want to know which regions have the highest tax rates?

Each province and territory in Canada has a separate provincial level of government that decides the Provincial Sales Tax (PST) rate that is imposed in addition to the federally mandated Goods and Services Tax (GST) (1). Due to this, some places are cheaper to reside in then others.

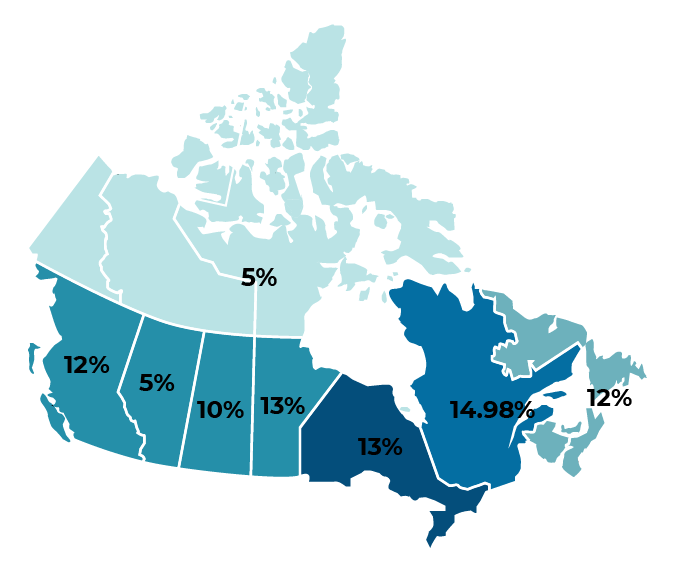

The provinces of Alberta, Nunavut, Yukon and the Northwest Territories boasts the lowest rate of 5%, while residents of the Maritimes (Nova Scotia, New Brunswick and Newfoundland/Labrador) pay the 15%.

Although 4 regions in Canada have a low rate of only 5%, only one of them is located in a central location – Alberta. This means that living in Alberta can be a cost efficient idea if you are basing your savings on taxes.

Want to see how much your payroll deductions will be after taxes? Calculate your take-home salary now!

Total Tax Rate By Canadian Province

(Updated November 2020)

Alberta

Alberta, located in the west of Canada, is the fourth most populous province in Canada (2). Alberta does not have any PST, so its residents only pay the required 5% GST rate (1).

PST: 0% + GST: 5% = Total Tax Rate: 5%

British Columbia

British Columbia (B.C.), located along the west coast of Canada, is the 3rd most populous area in Canada (2). B.C. has both GST and PST, creating a combined rate of 12% (1).

PST: 7% + GST: 5% = Total Tax Rate: 12%

Manitoba

Manitoba, located in the centre of Canada, 5th most populous area in Canada (2). Manitoba has both PST and GST, resulting in a total rate of 13% (1).

PST: 8% + GST: 5% = Total Tax Rate: 13%

New Brunswick

New Brunswick, located on the east coast of Canada, is the 8th most populous province in Canada (2). New Brunswick adapted the Harmonized Sales Tax (HST) which in combination with the GST results in a rate of 15% (1).

HST: 10% + GST: 5% = Total Tax Rate: 15%

Newfoundland and Labrador

Newfoundland and Labrador, the most easterly province in Canada, is the 9th most populous province in Canada (2). Newfoundland and Labrador impose both HST and GST on their residents, resulting in a 15% (1).

HST:10% + GST: 5% = Total Tax Rate:15%

Northwest Territories

Northwest Territories, located in the north of Canada, is the 11th most populous area in Canada (2). The Northwest Territories only impose the federal GST of 5% on their residents. This means the rate for the territory is 5% (1).

PST: 0% + GST: 5% = Total Tax Rate: 5%

Nova Scotia

Nova Scotia, located along the east coast of Canada, is the 7th most populous region in Canada (2). Nova Scotia collects both HST and GST which leave the province with a 15% (1).

HST: 10% + GST: 5% = Total Tax Rate: 15%

Nunavut

Nunavut, located at the north most point of Canada, is the least populous region in Canada (2). Nunavut does not have any PST and therefore the total tax rate is only 5% (1).

PST: 0% + GST: 5% = Total Tax Rate: 5%

Ontario

Ontario, located in the east-central region of Canada, is the most populous region in all of Canada (2). Ontarians are taxed both HST and GST resulting in a rate of 13% (1).

HST: 8% + GST: 5% = Total Tax Rate: 13%

Prince Edward Island

Prince Edward Island, located on the east coast of Canada, is the 10th most populous region in Canada (2). Prince Edward Island uses HST and GST to reach a rate of 14% (1).

HST: 9% + GST: 5% = Total Tax Rate: 14%

Québec

Québec, the only predominantly French-speaking region in Canada, is the 2nd most populated region in Canada (2). Québec is the only province that has its own provincial tax, the Quebec Sales Tax; rate being 14.975% (1).

PST/QST: 9.975% + GST: 5% = Total Tax Rate: 14.975%

Saskatchewan

Saskatchewan, one of the Prairie Provinces, is the 6th most populous area in Canada (2). Saskatchewan has a PST rate of 5%, which in combination with the GST, rate of 10% (1).

PST: 5% + GST: 5% = Total Tax Rate: 10%

Yukon

Yukon, the westernmost point of Canada, is the 12th most populated area in Canada (2). The Yukon does not have a PST and therefore only has a total rate of 5% (1).

PST: 0% + GST: 5% = Total Tax Rate: 5%

If you are relocating to Canada and searching for some advice on which region to move to, TransferEASE can help. At TransferEASE our knowledgeable relocation experts can help guide your relocation from start to finish, with care and attention.